Types of Risks

We will cover following topics

Introduction

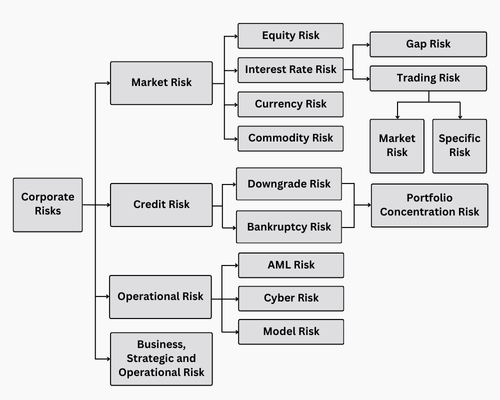

Different firms face different types of risks based on their operations and business strategies. Each type of risk carries its own characteristics, potential sources, and implications for the firms. The prominent risks faced by financial institutions include:

- Market Risk

- Credit Risk

- Liquidity Risk

- Operational Risk

- Business and Strategic Riskz

- Reputation Risk

The below figure shows various types and sub-types risks:

Types Of Risks

Market Risk

Market risk pertains to the possibility of financial losses arising from fluctuations in market variables such as interest rates, foreign exchange rates, and commodity prices. Market risk can be further sub-divided into different risks, based on the underlying asset. The primary market risk types include equity risk, interest rate risk, currency risk, and commodity price risk. Market risk is driven by:

- General Market Risk: It refers to how a stock price reacts to changes in broad market indices.

- Specific Market Risk: The risk related to to how a stock price responds to factors specific to the company (e.g., increased input costs, operational challenges, etc).

In order to manage market risk, it is necessary to understand the relationship between the underlying positions of a portfolio. For example, market risk in a large equity portfolio can be managed by diversification. However, the risk manager must be very careful while managing the market risk as these relationships can also create market risk. For instance, an equity portfolio designed to track a market benchmark might not do so perfectly, leading to tracking error—a form of market risk. Similarly, although hedging can be used to manage market risk, hedging positions can also introduce basis risk if the hedge does not perfectly offset the underlying position.

Risk managers often find that mismatches in price movements pose a greater challenge than individual market risk exposures. For instance, a commodity risk manager might opt to hedge the price of jet fuel with crude oil futures, relying on their historical price relationship. However, the hedge could fail due to an unexpected change in this relationship, rendering it ineffective, or potentially leading to greater losses than if no hedge had been implemented.

Credit Risk

Credit risk arises when one party fails to meet its financial obligations to another. Credit risk is further subdivided into four sub-types, as defined below:

- Default Risk: It is the risk that a debtor fails to pay interest or principal on a loan.

- Bankruptcy Risk: It refers to the risk that the counterparty will stop operating completely. For such a case, the concern is that the collateral might be insufficient to recover a loss flowing from a default.

- Downgrade Risk: It refers to the risk that if the creditworthiness of a counterparty is decreased, a creditor may increase the interest rate to offset the increased risk. For creditors, downgrade risk can ultimately escalate into default risk.

- Settlement Risk: It refers to the risk that the counterparty will fails to settle its obligations on the settlement date. Settlement risk is also called as cpunterparty risk or Herstatt risk.

Credit risk is influenced by the probability of default, the exposure amount at the time of default, and the recovery amount in the event of default. These factors can be managed through the quality of borrowers, the structure of credit instruments (e.g., collateralization, priority in bankruptcy, protective covenants), and exposure controls.

While the exposure amount is usually clear with loans, it can be volatile in other transactions. For example, a derivative might have zero credit risk initially but can become a significant exposure as markets fluctuate.

The probability of default is traditionally assessed by evaluating key risk factors, such as financial ratios, industry sectors, etc. The risk in credit portfolios is affected by obligor concentration (the exposure to each obligor relative to the portfolio’s value) and the relationships between risk factors. Portfolios are riskier if:

- They contain a few large loans rather than many smaller ones.

- The returns or default probabilities are positively correlated (e.g., borrowers in the same industry).

- The exposure amount, probability of default, and loss given default are positively correlated (e.g., higher defaults lead to lower recoveries).

Risk managers use complex credit portfolio models to identify risks arising from these factors.

Liquidity Risk

Liquidity risk can be divided into two distinct types: funding liquidity risk and market liquidity risk.

(1) Funding Liquidity Risk: Funding liquidity risk is the risk that a firm cannot obtain sufficient liquid assets to meet its obligations. This risk affects all types of firms, especially small and fast-growing ones that struggle to balance paying bills promptly while having enough funds for future investments. Banks face a unique funding liquidity risk due to the maturity and funding mismatches inherent in their operations. They take in short-term deposits and lend them out long-term at higher interest rates. Effective asset/liability management (ALM), including gap and duration analyses, is crucial in mitigating this risk. Failures in ALM were evident during the 2007–2009 financial crisis, where many banks with significant maturity mismatches failed due to the market’s perception of their creditworthiness.

(2) Market Riquidity Risk (Trading Liquidity Risk): Market Liquidity Risk, or trading liquidity risk, is the risk of asset value loss when markets become illiquid. This situation forces sellers to accept low prices or prevents them from converting assets to cash. Market liquidity risk can quickly become funding liquidity risk, particularly for banks reliant on fragile wholesale markets. Measuring market liquidity risk is challenging; normal market indicators like transaction volume and bid-ask spreads may not predict market behavior during a crisis.

Note: If liquidity risk becomes systemic, it can escalate into increased credit risk, potentially leading to default scenarios.

Operational Risk

Operational risk refers to the to the “risk of loss resulting from inadequate or failed internal processes, people, and systems or from external events”. It includes legal risk, but excludes business, strategic, and reputational risk. Operational risk encompasses various factors such as anti-money laundering risks, inadequate technology systems, weak internal controls, incompetent management, and fraudulent activities such as the intentional falsification of information. It also includes employee errors (such as data entry mistakes or accidental file deletions), risks from natural disasters, cybersecurity threats and rogue trading.

In financial institutions, the leveraged nature of derivative transactions heightens their susceptibility to operational risk. This risk is further exacerbated by the models used to price illquid complex assets whose prices are not aligned with mark-to-market requirements.

Business and Strategic Risk

Business risk arises from the uncertainties in customer demands, pricing decisions, supplier negotitations, competition, and amanging product innovation. Business risk is affected by the quality of a firm’s strategy and its reputation too.

Strategic risk refers to the long-term decision-making process concerning a company’s core business strategy. These strategic initiatives often require significant investments in capital assets or human resources. An example of a strategic risk is a shift in the regulatory environment substantially impacts the profitability of a project. Another example is a bank that relaxes its lending standards to increase loan origination, only to face elevated risk levels during a market downturn.

Reputation Risk

Reputation risk refers to the potential for a firm to suffer a decline in public perception or consumer acceptance. This risk can originate from two primary sources: a loss of confidence in the firm’s financial stability or perceived unfair dealings with stakeholders. Reputation risk often results from failures in other risk management areas.

For example, a significant credit risk event such as default of a firm can increase reputational risk of the firm. Similarly, the news of a cyberattack (a form of operational risk) can also damange the reputation a firm. In such cases, the reputational risk is further amplified through social media as the news is quickly spreds all over the internet. The impact of reputation risk can begin with reduced profits and escalate to insolvency as public perception and the firm’s value deteriorate.

To deal with reputational risk, firms must define their overall risk appetite clearly. They might adopt a conservative approach with respect to credit risk while embracing an entrepreneurial attitude towards business risk. The interconnected nature of different risk types means that managing reputation risk requires careful coordination across various risk management areas. For example, a company might face currency risk due to international sales or sourcing, which could be linked to new innovations.

Test Your Understanding

1) Which of the following is a correct example of funding liquidity risk?

A. A counterparty will not settle its obligations on settlement date.

B. An institution will not be able to raise cash necessary to make debt payments.

C. A counterparty will default on a financial transaction.

D. There will be a loss in portfolio value due to unexpected change in market prices.

B is correct. Funding liquidity risk is the danger that an institution will be unable to generate sufficient cash to meet its financial obligations as they come due. This type of risk is crucial for financial institutions and businesses, as it affects their ability to service debt, pay operational expenses, and manage day-to-day cash flow needs. It can arise from a variety of situations, such as market disruptions, a sudden withdrawal of deposits, or an inability to liquidate assets quickly. Managing funding liquidity risk is essential for maintaining financial stability and operational continuity.

2) Which of the following is a correct example of market liquidity risk?

A. An institution will not be able to raise cash necessary to make debt payments.

B. Investors begin to redeem their shares.

C. Depositors start to withdraw funds from banks.

D. A trader who sells an asset and then immediately buys it back, with a loss.

D is correct. Market liquidity can be expressed through three main forms: (1) bid-ask spread, (2) market depth, and (3) market resiliency. The bid-ask spread represents the potential loss incurred by a trader who sells an asset and then immediately repurchases it. A wider spread indicates lower market liquidity, while a narrower spread suggests higher liquidity. The other options are related to funding liquidity.