Risk Appetite and Decision-Making

We will cover following topics

Risk Appetite

Risk appetite refers to the levels and types of retains that a firm is willing to retain. It is critical to understand two subcomponents of risk appetite: risk willingness and risk ability. Risk willingness refers to a firm’s aspiration to accept risk in the pursuit of its business objectives, whereas risk ability can limit this willingness for various reasons. The most common factors reducing risk ability include internal risk controls designed to keep risk within a desired range and regulatory constraints. For example, banks are required to maintain a leverage ratio (percentage of Tier 1 capital to bank assets) of at least 3%.

Accepted Risk Relative to Risk Capacity

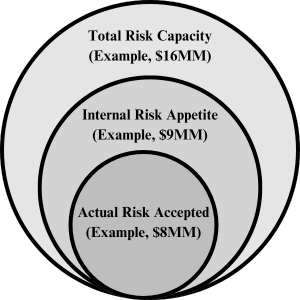

Since there is always a scope of error in the risk estimation process, the actual risk levels should be set below a firm’s maximum risk capacity. For example, suppose a firm has a total risk capacity of $16MM and the risk appetite is set at $9MM by the senior management. Accordingly, the risk managers should account for error in the risk estimation and set the level of actual risk accepted at a level below $9MM, say $8MM.

The below figure illustrates the level of accepted risks relative to risk capacity:

Accepted Risk Relative to Risk Capacity

Risk Mapping

After setting the risk appetite, a firm maps its key risks at the cash flow level. The firm also assesses the size and timings of these risks over particular time intervals. For instance, a firm involved in manufacturing might face significant commodity price risks, such as fluctuations in the price of copper. A risk manager in this scenario would begin by forecasting the firm’s copper requirements, considering factors like when and where the metal will be needed and identifying the local price benchmarks that best represent the firm’s risk. Additionally, a firm might encounter foreign exchange risk. The initial step here involves mapping out current positions, contracts, and future transactions. The firm then needs to establish a policy to determine which exposures should be hedged, such as whether to include anticipated but uncertain sales. It is also crucial to schedule the timing of cash flows and understand the assets and liabilities affected by exchange rates.

In some cases, cash flows may naturally offset each other. Mapping risk helps to identify these netting and diversification effects and to create a strategy to enhance them in the future. Furthermore, a firm might face risks that require insurance, such as natural disasters, physical accidents, and cyber incidents. Risk mapping should also account for risks that are challenging to quantify in terms of exposure and cash flow. For example, a new business line might introduce substantial data privacy risks and foreign exchange exposures that are difficult to measure. The risk emanating from the introduction of such a business line should also be mapped.

Risk Management Strategies

After setting the risk appetite and mapping the key risks, a risk manager can decide the risk management strategy for each risk. First, risk managers must identify and prioritize the most critical and urgent risk exposures. Next, they need to evaluate the costs and benefits of different risk management strategies. The risk management strategies include:

1) Retain

2) Avoid

3) Mitigate

4) Transfer

It is the responsibility of senior management and the board to select the risk management strategies for significant risks.

Test Your Understanding

1) The board of directors of a firm play a crucial role in hedging the exposure to risk factors. Which of the below statements is incorrect regarding the role played by the board related to hedging?

A. The objective should be clearly stated by the board in terms of whether the economic or accounting profits need to be hedged.

B. The time horizon can be ignored by the board when determining the risk management goals for the management.

C. It is the responsibility of the board to ensure that the goals of hedging are stated in a clear and actionable manner.

D. The board is required to set and communicate the firm’s risk appetite.

B is correct. The board of directors must clearly define the time horizon when setting risk management objectives for the management team to achieve. For instance, if a futures contract is used to hedge future sales receipts, it can lead to a timing mismatch in reported profits for accounting purposes. This mismatch occurs because the gains or losses on the futures contract may be recognized in a different accounting period than the underlying sales receipts, potentially distorting the financial statements. Therefore, it is crucial for the board to establish a precise time frame for risk management strategies to ensure alignment with the company’s financial reporting and overall business goals.